How to Leverage Alma for Smarter Real Estate Decisions

Can AI in real estate really enhance your investing?

We think so.

That’s the main reason we created Alma for investors like you. And, if you’ve kept up with some of our other blogs you already know how real estate AI (especially Alma) is a game changer.

But if not, here is just a fraction of the things Alma the AI real estate Assistant can help with deal analysis, investment strategies, scripts for cold calls, scripts for text, market analysis, and MUCH MORE!

In this blog, we will break down, in-depth, how Alma can help you make smarter real estate decisions.

The Role of AI in Real Estate Investment Decisions

As you might already know, correctly assessing a property's worth is one of the fundamental elements in real estate investment. It can significantly impact the profitability of an investment. Leveraging AI and data analysis, Alma provides an estimate of a property's value considering a range of factors such as location, square footage, and recent comparable sales in the area. Cut down on the work of property valuation by hand while still making informed decisions about buying, selling, or holding a property.

Additionally, Alma can provide information on neighborhoods that it pulls from DealMachine’s property data. It can do on-the-spot property analysis, find cities suited for investing, and analyze rental potential for an area. Alma's ability to analyze and present this neighborhood data can assist investors in selecting the right properties in the right neighborhoods.

Alma also has the capabilities to do deal analysis and serves as a guide for investment strategies, but we will dive more into that later.

The advantages of using ai in real estate is that you can decide best how you want to leverage it. If you are new to investing and need help with strategizing let Alma serve as your guide. If you are a seasoned investor and are looking to shave off some time, Alma is also for you.

Now, AI is not always perfect, so be sure to utilize it as a guide, not the source of truth. It really is a time-saving guide with answers tailor fit to your needs versus searching through pages of search results, a mountain of articles, or even hours of videos on YouTube. Those resources do have a place, but if your looking for an instant answer that is surrounding your exact situation AI, like Alma, might be exactly what you are looking for.

How Alma Enhances Deal Analysis

Deal analysis is one of the most vital stages in real estate investing, and this is where Alma comes to the fore with its extensive capabilities. Are you looking for a property to wholesale real estate, flip, or buy and hold? Alma’s got your back in analyzing that deal.

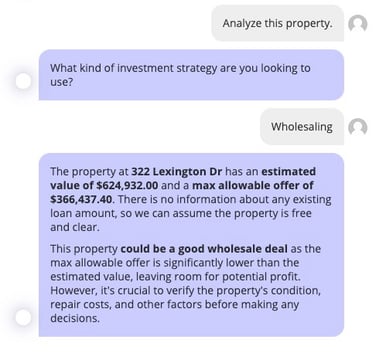

Let’s lay out a few scenarios and examples of how Alma does this. First up is wholesaling. Alma will look at the data available on the estimate, look at a max allowable offer, and if the property has a loan.

And if you’re curious Alma calculates the max allowable offer like this:

“The Max Allowable Offer (MAO) is a calculation used by real estate investors to determine the maximum amount they should offer for a property. It is calculated using the following formula:

MAO = (ARV x 70%) - Rehab Costs - Wholesale Fee

Where:

- ARV (After Repair Value) is the estimated value of the property after it has been repaired and renovated

- 70% is the percentage of ARV that investors typically use to account for the costs of repairs, closing costs, holding costs, and other expenses

- Rehab Costs are the estimated costs of repairs and renovations needed to bring the property to a marketable condition

- Wholesale Fee is the fee charged by the wholesaler, if any, for finding and assigning the property to the buyer

In the case of the property at 322 Lexington Dr, the Max Allowable Offer (MAO) is calculated as follows:

MAO = ($624,932.00 x 70%) - $71,015 - $0 = $366,437.40

Please note that this is a rough estimate, and actual repair costs and other expenses may vary. The MAO should be used as a starting point for negotiations, and the final offer should be based on a thorough analysis of the property's condition, location, and other factors.” - Alma

If you’re ever curious as to how Alma made a calculation don’t be afraid to ask it! I just did and might I say that breakdown made it super easy to understand.

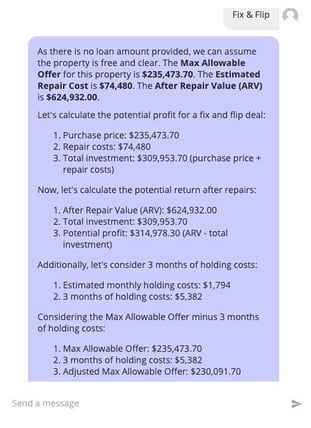

Next, let’s see how Alma can analyze a property for a flip. Alma again pulls data for the max allowable offer, repair costs, and an estimated ARV based on comps. Not only does Alma pull all those data points, but it also calculates the potential profits, potential returns after repairs, and even factors in holding costs.

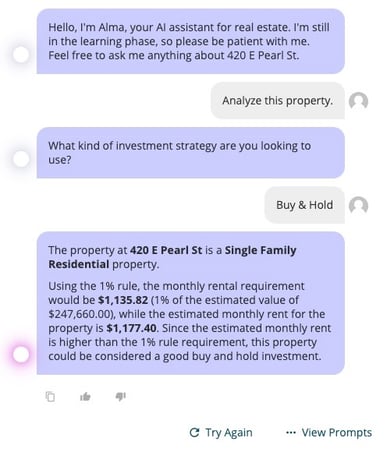

Last, but not least, how does Alma analyze a buy-and-hold deal?

Alma calculates this by using the 1% rule for single-family residential properties. It uses that to calculate the estimated rent required by the 1% rule.

Sometimes Alma is able to grab the monthly estimated rent based on rent for the area and comps. if that is the case, you can get a green light or red light for investing in the property. If it isn’t available Alma may ask you for the purchase price to see if it would meet the 1% rule requirements before saying yes or no to a property.

Don’t worry if you aren’t sure about offer prices for the property, Alma can calculate those for you too!

Alma’s Contribution to Strategy Formulation

In the realm of real estate investing, effective strategy formulation is paramount to ensuring success. Alma’s artificial intelligence capabilities play an instrumental role in this process. By leveraging big data analytics and machine learning, Alma provides investors with valuable insights that serve as the foundation for their strategic decisions.

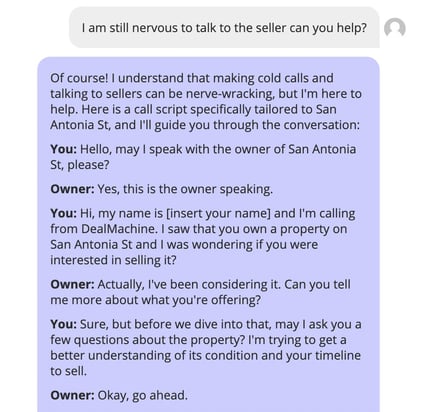

Need to know how to wholesale, the steps to wholesale, and how to find buyers? Just type it in and Alma helps you strategize. Not only that but if you are nervous to talk to a seller Alma can role-play a conversation between you and the seller. And if you ask Alma how to help not be so nervous it will give you some techniques to help.

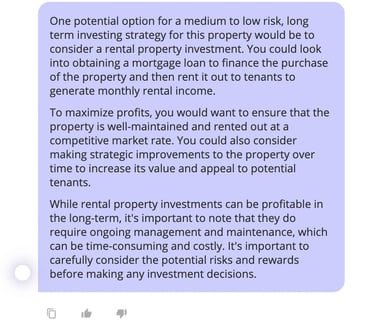

Alma also supports the creation of tailored investment strategies based on an individual’s risk tolerance, financial goals, and investment horizon. By understanding the investor’s profile, Alma can suggest optimal property types and investment structures that align with their objectives. This personalized approach ensures that each strategy is not only data-driven but also customized to suit the unique needs and goals of every investor.

For example, I asked Alma to provide me with a long-term investing strategy with medium to low risk, and this is the strategy it gave me.

Maximizing Alma’s Capabilities for Smarter Investments

In order to maximize the benefits of Alma, one must understand and effectively employ its full range of features. While the use of AI might seem daunting, especially for new investors, the good news is that Alma is designed to be user-friendly and easily accessible to all, irrespective of their level of expertise in the real estate sector.

Remember that Alma's capabilities aren't just restricted to providing information – it's also an analytical tool. This means that it doesn't just serve up raw data, but processes it to generate insightful and actionable analysis. Whether you're trying to assess the profitability of a potential property investment, or looking to understand trends in rental prices in a particular neighborhood, Alma's AI-powered analytics can give you the necessary edge in your investment decisions.

Moreover, Alma's features aren't limited to deal analysis and strategy formulation. The AI assistant also offers features such as cold call and text scripts. Leveraging these, investors can improve their communication and negotiation skills, making it easier to close deals.

Ultimately, the key to maximizing Alma’s capabilities lies in integrating the AI assistant into your daily real estate investing activities. By making Alma a regular part of your decision-making process, you'll be able to reap the full benefits of AI in real estate investing. By doing so, you'll not only gain more confidence in your investment decisions but also ensure that they're backed by solid data and advanced analytics.

Conclusion

Alma showcases a broad spectrum of capabilities, including property valuation, deal analysis, strategy formulation, and even role-playing conversations. Leveraging big data and machine learning, Alma transforms raw data into actionable insights that guide smarter investment decisions.

Whether you're a seasoned investor seeking time efficiency or a novice needing guidance, Alma's user-friendly design and powerful analytics can significantly enhance your investment journey. However, as advanced as AI may be, remember to utilize Alma as a guide, not the ultimate source of truth, ensuring that your decisions are well-informed, data-backed, yet personalized to your unique investing needs.

About Samantha Ankney

Samantha is the Social Media Manager at DealMachine, where she oversees all social media strategies and content creation. With 3 years of experience at the company, she originally joined as a Media Specialist, leveraging her skills to enhance DealMachine's digital presence. Passionate about connecting with the community and driving engagement, Samantha is dedicated to sharing valuable insights and updates across all platforms.