A Beginners Guide: 11 Tips for Flipping Your First House

“I don’t have enough experience or money to flip a house.” Sound familiar? Here’s the truth. Flipping a house is a skill. Like any other skill you can learn it and improve. Don’t believe me? There are 1,500 people who subscribe to my app called DealMachine in order to flip a house. 50% of them have had no prior experience flipping homes.

Yep. No prior experience. Seems impossible while working a 9-5, too. You’re at work 8 hours, you commute 30 minutes each way. After coming home, eating dinner, and running errands, when would you possibly have time? But, you don’t need to quit your job to do it.

In fact, this house flipper has grown his business enough to hire an employee while he still works a 9-5 (because he likes his 9-5).

|

|

Kevin (left) still works his 9-5 sales job. He likes it. House flipping helps him build wealth for retirement. It has also allowed his wife to quit her job and spend more time with their kids. Kevin is about to hire his first full time employee because he has more opportunities than he can personally manage flipping houses.

If they can do it, so can you. Many house flippers also don’t start with a ton of money. Let me show you.

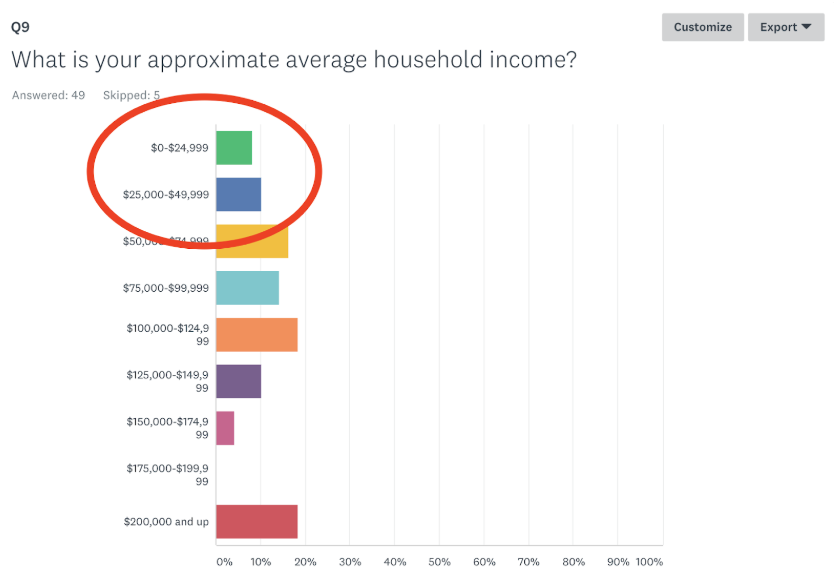

8% of them were making $24,999 or less per year at their 9-5 when they started. 18% of them were making $49,999 or less per year at their 9-5 when they started.

People in all financial situations are flipping homes. You can too. Because risking thousands of dollars is not required to get started - I believe that is a main reason more people flip homes now than any other time over the last 10 years (source).

More people flipping can mean lower returns for most. BUT, you actually have an advantage now as a DealMachine user. The real estate lead management software can help you be more personal and targeted to make your flips more profitable. There were not as many resources available when I was first getting started.

I’ve learned, tested, and improved methods for finding deals over the last 2 years as a real estate investor and put together these 11 essential tips for you. Whether you’re completely new to flipping homes or an experienced flipper staying up with the latest techniques, I’ve compiled these easy tips so you’ll do your next deal in no time.

1. Realize that flipping houses is a skill that you can learn.

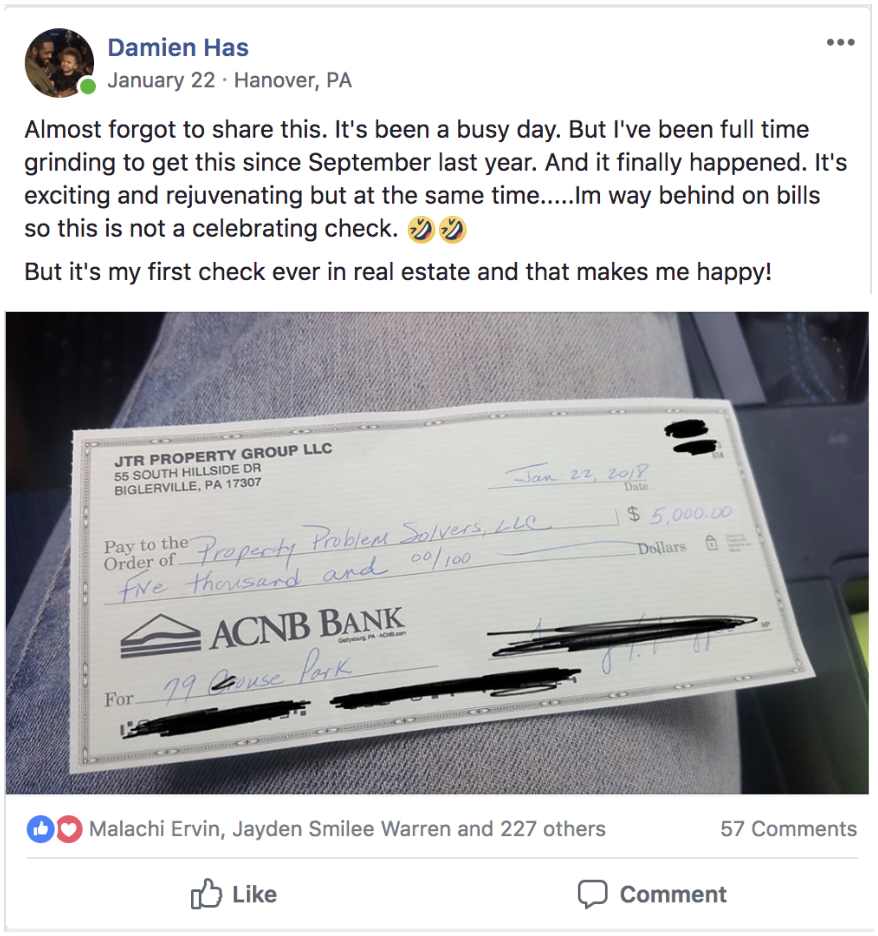

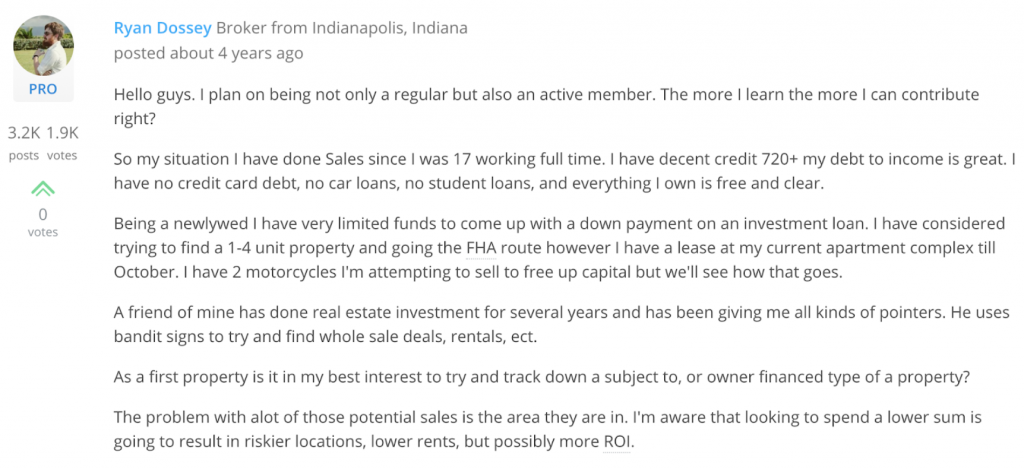

My friend Ryan Dossey looking for his first property with no money 4 years ago on Biggerpockets.com Four Years Later...

|

|

Ryan Dossey after he flipped 74 properties and bought over 2 million in rentals.

Just like learning a language, flipping houses is a skill you can learn. If you want to speak fluent Spanish, you have to start by learning words and phrases before you can speak Spanish fluently. Flipping houses is learned the same way. You gain a depth of understanding by DOING activities related to flipping.

As you work through the steps, you will eventually complete your first flip and feel completely comfortable with the entire process.

2. Familiarize yourself with what areas are HOT for investors in your local market by attending a meetup.

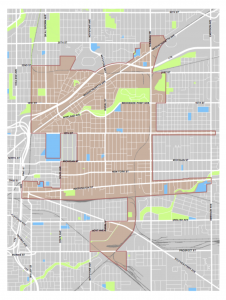

The East Indianapolis Promise Zone. One of 22 Federal Promise Zones where the government give investors money to flip homes. Whether your city has a Promise Zone or not, talking to investors will teach you the best places to flip homes.

The place where you want to live is likely different than the places where real estate investors want to buy. For your first flip - sell it to investors. Investors are easy to sell to because they operate a business with criteria.

You can learn exactly what they will pay for which type of houses. Investors also buy multiple homes per month, so you can bring your second and third deal to the same buyer. Much easier than trying to please the general public and trying to find a new buyer each flip.

Go ask some investors where they like to buy homes, plug the location into the driving for dollars app, and cross-reference that area to gain some intel. Ask them to describe their ideal property, and how much they usually pay for that. Find investors at your local real estate meetup, and check out DealMachine's list of best cities for flipping houses. Google “Your City” and “Real estate meetup” to find a meeting near you and attend. Once you’re at the meeting, use these scripts to approach investors during the networking portion of the meeting, or at the end when everyone gets up:

*********

SCENARIO: Asking Investors What They Want to Buy at a Meetup

** Find Someone Who Looks Approachable or Is Standing Alone **

ME: Approach them. Say “hi” and reach out your hand to shake theirs. Hi, my name is David.

/// Slight Pause

ME: How’s it going?

/// Person Responds

ME: I’m working on finding properties that investors can buy at a discount. Do you know anyone who buys properties regularly that I should connect with?

// Prospect Response: “Yes I do all the time” or they will point someone else out that you should go talk to.

ME: Perfect. What types of properties do you like to buy? Where do you buy? Is there anywhere you won’t buy? Take notes in your phone. Get their email address so you can send them properties. Do this for at least 3-5 people so you can get a good idea about where people really like to buy. Not just one person.

*********

3. Solve 90% of your uncertainty by choosing 1 method for finding a deal.

The key to making money on a flip is buying low. You need to find a property that’s worth more than you pay for it. You do that by finding someone who NEEDS to sell. So, why would someone need to sell so badly?

Divorce, bankruptcy, death, decline in health, can’t afford repairs needed, or sometimes nobody else will buy their property because too many repairs are needed. Don’t worry about those repairs for now. As far as you’re concerned, the more repairs needed, the more $$ you can make. Your only job is to FIND these people who need to sell.

There’s lots of ways to find desperate sellers. Most new flippers fail because they don’t FULLY execute on any specific method. For now, just familiarize yourself with the common options. Each one has a time vs money tradeoff.

| Time Investment | Money Investment | Marketing Method | Comments |

|---|---|---|---|

| High 16 hours | Low $650 - $1000 | Looking for distressed homes | Perfect for learning. |

| Low 2 hours | Medium $1000 - $1500 | Paying someone to look for distressed homes | Perfect for best profits. |

| Low 1 hour | High $2500 - $4500 | Buying a mailing list | Perfect for increasing volume. |

| Medium 4 hours | Medium $1000 - 2000 | Digital Marketing | Perfect for increasing volume. |

Pick a method that matches the money / time balance that works for you. And make sure you stick with it, for now.

4. Fully test your marketing method by asking flippers in your market what their numbers look like.

There’s no need to reinvent any wheels. Ask flippers how many pieces of real estate direct mail they typically send in order to get a deal. Or ask them how much they spend on digital marketing to get a deal.

Meetups are great for running into flippers and asking questions. Use their numbers as your goal to make sure you send enough marketing. For example in the Indianapolis market, flippers spend $2500 buying a mailing list and sending bulk direct mail to get one deal. For one of our clients in the Minneapolis market, they spend $4500 buying a mailing list and sending bulk direct mail. That’s a lot of money to spend/risk for a new flipper. Let’s take a look at a lower cost method.

The Numbers: Looking for distressed homes.

Based on 1500 flippers who use DealMachine across the United States. The magic formula is: Find 200 houses. Send mail 3 times. Get one deal. Time required: 2-8 hours. You’re actually going to go out and about looking for homes that: look run down, need maintenance, have tall grass, broken windows, tarp on the roof, worst looking house on the block, et cetera.

Depending on the neighborhood you could find 200 homes in as little as 2 hours (scroll up to section 2 for a reminder how to pick where to look). Here is the money investment: First mailing $.99 each (x 200 properties = $198) Second mailing $.99 each ($198) Third mailing $.99 each ($198) Total $594 to get one deal.

If you want to reduce your time investment: pay someone to look for you. 8 hours x $20 = $160. That brings your total investment to $594 + $160. Well under $1000 to get one deal.

5. Ensure successful timing by repeating your marketing at least 3 times.

Timing. Timing. Timing. How long do you think their distressed home as been like this?

Years.

So the first time you contact them with a postcard to buy their property… do you think they’re magically going to be ready to sell? Hell no! Otherwise they would have already sold their house.

You’re going to have to wait patiently (a little bit). If you find enough of these homes (we recommend 200), you’ll find one that IS timed well and ready to sell. Keep mailing the rest too, and more deals will come. Think about dating, where timing also plays a big role.

Two people must be attracted to each other AND ALSO they must both be looking to date someone new at that same moment. You are attracted to this house. The owner probably should fix it or sell it, but they haven’t for some reason. Typical. Then something happens: a death, a flood, a surgery, an injury, a chilly breeze catches them the wrong way.

All of a sudden they need to unload this house quickly. They see your postcard in the mail. So they call you. If you only sent mail one time, you’d be totally wasting your time. Mail your list of properties a MINIMUM of 3 times to get one deal. If you don’t, your time and money spent be totally wasted.

6. Don’t sweat talking to sellers by listening to a few example phone calls.

|

|

When you send marketing to property owners, they are going to call you about selling their house. “What do I say on the phone when a seller calls me?” That’s the number one question new house flippers ask.

Don’t sweat it. YOUR ONLY JOB is to turn that call into an appointment to visit their property. That’s easy. Check out the examples above explaining what you can say on the phone to do it.

7. Have fun walking the property, taking pictures, and chatting with the owner.

There’s a reason why millions of people watch HGTV. People LOVE before and afters. Now is your chance to enjoy seeing one first hand. And it starts with your visit to the property.

Enjoy it! The owner called you because they need to sell their house. Greet them. Tell them you’d like to take pictures in order to help you make your offer. Tell them you’ll be working with investors to buy their property. Ask them why they’re selling. Ask them how much they think the house is worth. Be curious.

There’s literally nothing else you need to do at this stage. Just gather information and take pictures of everything. You’ll use the information you gather later to make an offer.

8. Before you worry about designing a home renovation, flip your first house without updating a thing.

Did you see that collapsed foundation? A cockroach problem, or mouse droppings? Scary, right? That’s exactly why nobody else will buy this property.

Relax. All these “problems” are where flippers can really make their money. Plus, for your first flip you won’t even be fixing a thing. You see, there are 100,000s of investors who want to buy homes exactly like the one you’re looking at.

Investors often buy 30 homes like this per month. With Cash. In Indianapolis, Alpine Property Solutions buys that many every month. And that’s only ONE BUYER in ONE CITY. They typically buy in multiple cities because they simply want to get their hands on as many properties as possible. That’s where you come in.

What are you waiting for? They’re ready to buy. Groups like Alpine even provide a cheat sheet that says exactly how much they pay for which type of houses. That takes the guesswork right out of the flip. But don’t worry. You don’t even NEED a cheat sheet. I’ll show you.

9. Avoid using your own money and make an offer using an assignable contract.

You’ll invest a little time and money to find the deal. However, that’s about it. After you visit the property, your next step is to make an offer.

Feel a little daunting? Yeah, for me too. At first. Until I realized two things:

1). Getting this house under contract locks out any of my competition. Nobody else will be able to buy this home except me once it is under contract.

2). I can break the contract without losing much (sometimes nothing). First of all, let me explain how to flip a house without using your money to buy it. Once you get a house under contract, find another buyer before the closing date.

It’s that simple.

Here’s Margot Robbie in a bubble bath to explain.

Margot: You’re a deal maker. Not a buyer. You can “assign” your contract to another buyer before the closing date. That means the buyer gets to take your place on the contract. THEY will close on the house. Not you. And the buyer pays you an “assignment fee” to take your place on the contract. The buyer uses THEIR money. The assignment fee is your profit.

If you can’t find a buyer before the closing date for some reason, still no big deal. Typically when you make an offer on a house, you have to show the buyer you’re serious. The way you do that is by forking over “earnest money.”

Let’s say you’re buying a $200,000 house with a realtor on the market. Your earnest money might be around $2000. If you break the contract, you don’t get your earnest money back. BUT this home owner is no ordinary seller. They’re really motivated to sell their house. Their house is in bad shape. So when you make the offer, use $50 of earnest money. $0 even works. They’ll take it 9 times out of 10. Also, use a contract with an inspection clause.

Typically you can give yourself 15 days to inspect the house. If there’s something major wrong with it, you can get your earnest money back. No big deal.

10. Know how much to offer so you can make a profit quickly.

You don’t need to be a math wiz. Your numbers don’t need to be precise. Calculating your offer can be simple. YOUR PROFIT = (The price you end up selling the house for) - (cost of repairs needed) - (your offer price) Right now, we want to know the price you should buy it for.

Let’s rearrange the formula:

YOUR OFFER PRICE = (The price you end up selling the house for) - (cost of repairs needed) - (your profit)

Now, you may get hung up here because you feel like getting the numbers wrong will lose you money. That’s a common feeling. Explore what's included in a real estate profit and loss statement to familiarize yourself with the factors. But the reality is, you can make offers without worrying about losing money. To overcome it, I created the “Rapid Risk Free Offer” technique.

You can follow the steps below:

The “Rapid Offer technique” for purchasing a house without risking your money.

You need two things to make an offer on a house:

- A written purchase agreement

- An offer price.

The purchase agreement is easy. Here is the simplest purchase agreement I have ever seen. I use it. You can use it too. Just run it past your lawyer. The trickier part for most people is determining the best possible offer price.

Here’s that formula again: YOUR OFFER PRICE = (The price you end up selling the house for) - (cost of repairs needed) - (your profit)

The price you end up selling the house for.

Commonly called After Repair Value or ARV for short. Look on Zillow for similar homes in great shape in the area. If you’re wrong, not a big deal. Find that number and keep going. We don’t need precise numbers right now.

Cost of repairs needed.

Ever hired some work done to your house that cost more than expected? Yeah, I thought so. Experienced contractors estimate wrong all the time. They don’t mean too, it’s just hard. So you’re trying to estimate accurately… why? Grab a copy of “The Book On Estimate Rehab Costs” by J Scott. Make a quick estimate and go the the next step in the process.

Your profit.

This is what you came here for. Pick $5000 profit for your first flip. Sure, you can make a lot more. But the purpose of your first flip is to TEACH you how to do more. The speed of getting this deal done is crucial. It will open your eyes and you will see how to profit more on your next flip, I promise. N ow plug all your numbers into the formula and you have YOUR OFFER PRICE. Many investors say “you should feel very uncomfortable with how low your offer is.” I agree. Once you come up with your offer price, then reduce it by 20%. If your offer price came out to $100,000, change it to $80,000. Fill that into your purchase agreement. Get ready to deliver it to the buyer. If you get the offer price wrong, you can change it.

Don’t believe me? Imagine: Super motivated buyer calls you to sell their house fast. You visit the property. You make them an offer. They accept. Your closing date is in 30 days. 5 days before closing the WORST has happened. You haven’t found a buyer (see step 11 for finding a buyer).

The Buyers in step 10 will give you feedback on how much they’d pay for the property. You call the owner and ask if they still want to do the deal. They say yes. Great. You say the price needs to be X amount LOWER in order to do the deal. They aren’t happy about the lower price. But they still really need to sell. They say yes. You adjust the contract. You find a buyer. They close. You get a paycheck. You send a picture of it to your best friend / your mom / significant other. They reply back: “boom!” You cash your check. I hand deliver the offer, or email the offer via docusign to the seller.

11. Find a buyer for the house before you even close on it.

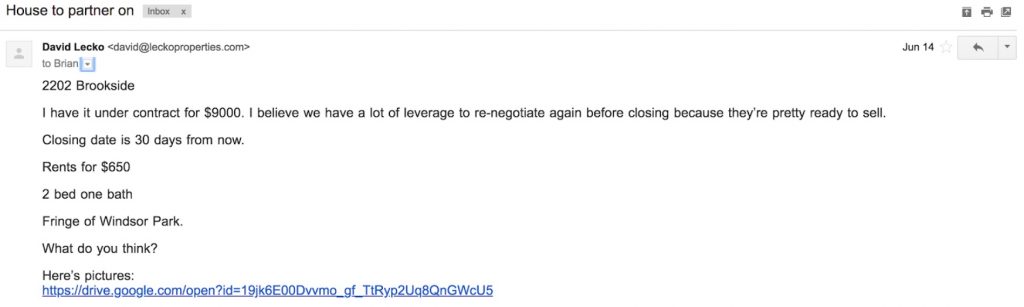

Google “We Buy Houses” plus “your city.” Send this email to the top 5 companies who come up:

Serious home buyers in your area will either:

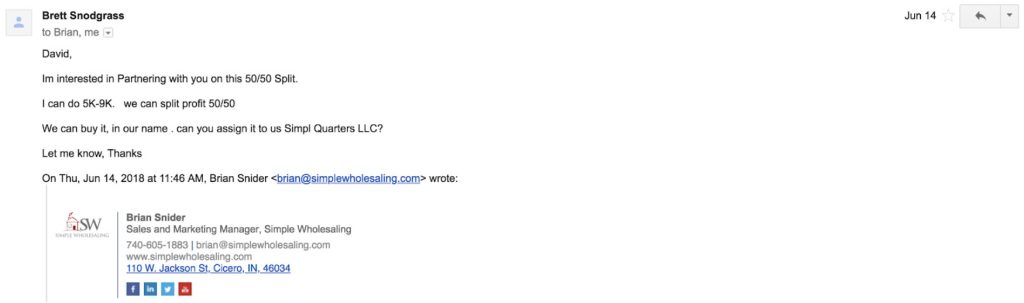

1) make you an immediate offer on the house or 2) send the house to their buyers list and split the profits with you 50/50 when they sell it.

Both are great options to flip your first house instantly.

And here's how they responded:

This homebuyer offered to send my house to their buyers list and split profits 50/50. Expected profit $5000-$9000. No work done by me. Good option to flip it immediately.

Get a $5000 - $20,000 check that you can take to the bank and get ready to do it again.

YOU JUST FLIPPED A HOUSE.

Put your hand on the screen. You know you want to. That probably took you 2-3 months in your spare time. Ready to do your next? I thought so. And you’ll start to see ways to do your next deal even faster. Maybe even one deal per month.

You’re starting to see how this type of flipping could double your income, let you or your spouse quit their job, go on an extra vacation this year, pay off student loans, upgrade your ride. You pick!

Flipping your first house is easier than you think.

It’s really just a set of steps. Learning what areas are hot, how much marketing it takes to get 1 deal, how to manage leads in the DealMachine house flipping software, and how to find a buyer is all you really need. Once you do your first flip there will be tons of ways you’ll realize to make more money per deal and earn extra paychecks all the time.

Want to find your next deal even faster? Download my free case study: “The 10 Second Method for Finding Real Estate Deals.” The study highlights over 1,500 flippers nationwide who’ve utilized the DealMachine App for successful finds and flips. With my case study, you’ll know exactly what it takes to find a deal in your market within minutes. Too good to pass up, right? Just enter your info below and I’ll send it to you. It’s that easy.

About David Lecko

David Lecko is the CEO of DealMachine. DealMachine helps real estate investors get more deals for less money with software for lead generation, lead filtering and targeting, marketing and outreach, and acquisitions and dispositions.